Artikel diperbarui pada 18 May 2024.

Current account is a transaction recapitulation document provided by BCA bank for a certain period. Currently, there are many examples of BCA bank statements, but not many people know how to print them and what they are used for.

In this article, of course, it will be discussed more clearly about the three starting from how to print, examples and also their uses. Where each will have a detailed, simple and easy to understand explanation for BCA Bank customers.

How to Print BCA Current Account

Before printing a BCA bank statement, there are several conditions that must be met first. That’s because the printing should not be arbitrary. The conditions are as follows:

- Original BCA savings book.

- KTP or personal driver’s license.

- ATM card from the savings book.

- Prepare an administration fee ranging from Rp 2,500-Rp 10,000 depending on the printing period.

After these requirements have been met, the next is to follow the printing method or procedure. The method consists of 2 methods, namely offline to the branch office and online via M-Banking. The explanation of both is:

1. Visit the Branch Office

Currently, BCA branch offices can be found anywhere. Please visit the nearest one. For how to print a current account through the branch office itself, the steps are:

- Complete the required documents.

- Visit the nearest branch office and take the queue number.

- Wait until called according to the queue number.

- If you have been called, convey the purpose or purpose of wanting to print a current account from a savings book.

- Submit the documents that have been prepared as requirements.

- Deliver the printing time period with a minimum of one month.

- Make the requested administration payment according to the requested period.

- Wait for printing by the officer.

- After that, receive the physical form of the current account.

- Finished, the bank statement has been printed and received.

2. Using BCA M-Banking that has been registered

When you set up a BCA savings account, you usually register and activate M-Banking immediately. This makes it practical because you can do various transactions easily including printing your account online with the following steps:

- Connect your smartphone that already has the BCA M-Banking application with a smooth or stable internet.

- Open the BCA M-Banking application and enter the username and password.

- On the main page there are various menu options and just select “KlikBCA”.

- In the menu, click on the blue “Full Site” option on the right side of the middle screen.

- A new desktop view will appear and then proceed to select the “e-Statement” menu to print the bank statement.

- Select the current account “Savings and Current Account” then specify the time period for which printing will be done.

- If so, a PDF file will appear that can be downloaded and stored on the device.

- Download the bank statement file and you’re done.

Example of BCA Current Account and its Explanation

In this article, examples of BCA bank statements will also be provided so that they can be used as a reference before printing. The following are some examples and explanations:

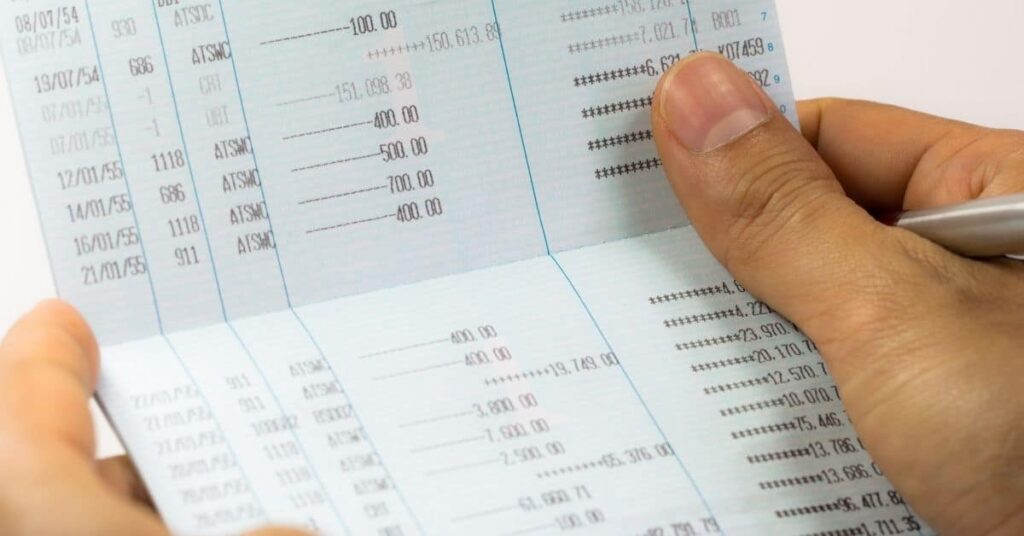

1. Example of Original BCA Current Account Print From Office

The original BCA bank statement in physical paper form is given directly by the service officer from the BCA office. Usually there is a wet signature of the officer and an official stamp. Here is the picture:

2. Example of BCA M-Banking Current Account at “KlikBCA”

As explained earlier, BCA M-Banking also provides a feature to print a bank statement. It’s just that because it is done online, the format is only in the form of PDF and can be printed by yourself. The image is as follows:

3. Example of BCA Online Current Account Tahapan

This current account for Tahapan usually contains transactions over a period of one month. The display is not too much and adjusts how much BCA customers make transactions. For more details, please see the following image:

4. BCA Xpresi Current Account Example

Almost the same as the Stages but for this BCA Xpresi KOP is different. There is its own description for the Xpresi current account which is one of the differences. The picture itself is:

5. Example of BCA Current Account for 3 Months Period

Customer requests in printing this current account are of course according to their needs but the minimum is 3 months. For this 3-month period, of course, it is different from the one month with the following image:

6. BCA E-Statement MyBCA Current Account Example

This type of BCA statement can also be found on the M-Banking platform provided by BCA. Similar to the others, it displays a clear and structured recapitulation with an example image, which is as follows:

7. BCA Mobile Current Account Example

Regarding the type of current account from BCA mobile is slightly different compared to the others. It is because the display of the smartphone that may affect it. As for the picture itself is as follows:

Uses of BCA Current Account

In addition to providing a view of the recapitulation of customer transactions, this current account from BCA has various useful uses. The uses include:

1. Provides a Transaction Display of All Forms

In the bank statement, all transactions will be displayed in various forms. Starting from income, expenses to admin fees and other transactions. That way the customer will know the flow of the use of money in the account book.

2. Can be used to apply for a loan

Current accounts can now be used as supporting documents to apply for loans. It is a consideration for the lender how the prospective customer uses the funds or money he has through his bank account.

3. Can Be Used as Legal Evidence

Legal evidence here means that if there is misappropriation of funds by certain parties, the transactions that occur can be seen in the bank statement. That way the person cannot avoid and must be responsible for the misappropriation.

4. As a Document for Visa Application

Currently, a bank statement is one of the requirements for applying for a visa to go abroad. It is so necessary as a consideration whether the funds in the account are sufficient or not to be taken abroad.

5. Can be Used to Participate in Auctions

The amount of account balance when you want to take part in the auction is one of the main requirements. Therefore, a bank statement is one of the documents that must be attached when registering to participate in an auction event.

6. As a Tool in Conducting Audits

Current accounts are very useful for auditors to do their work. By knowing the flow of transactions that occur in the bank statement, the audit process can continue. Many transactions occur and will have an influence on the reports it produces.

This is a complete explanation of how to print and examples of BCA bank statements and their uses. By knowing it, the example can be used as a reference before printing the current account.