Artikel diperbarui pada 11 January 2024.

Debit card is one of the card-shaped transaction tools that can cut the consumer’s account balance if used to buy something. Debit cards have several numbers that can be seen, one of which is the CVV of the debit card that the owner needs to understand. CVV on debit cards can be misused by irresponsible people. Therefore, debit card users must be familiar with CVV. The following will explain more information,

Debit Card CVV

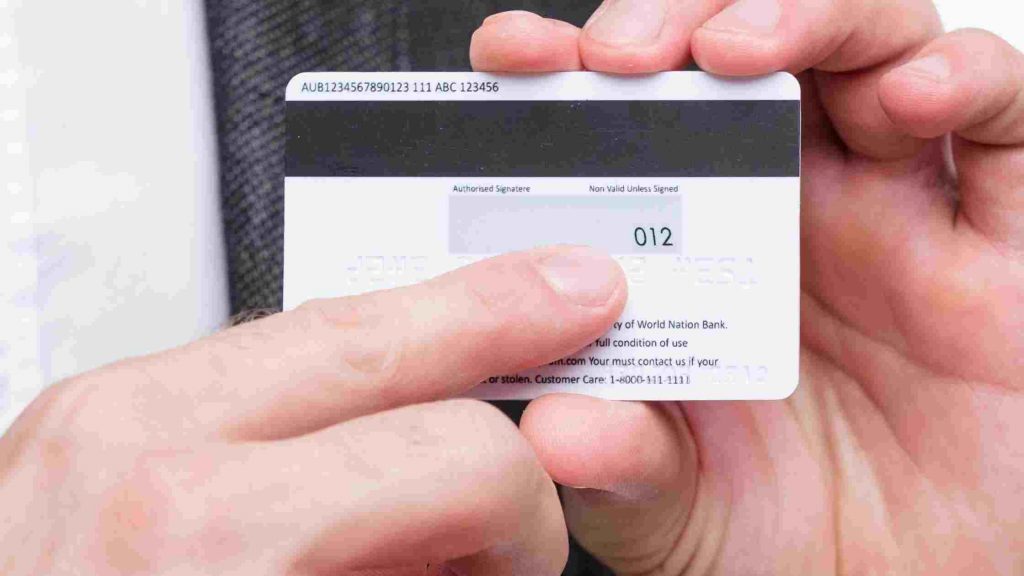

In 1997, the first CVV (Card Verification Value) security code was issued by the Mastercard company. After that, in 2001 it was followed by the use of CVV (Card Verification Value) on VISA. CVV (Card Verification Value) are three numbers located on the back of a debit card. The number is also known as the CVV security code because it has an influence on debit card security. Besides the term CVV, there is also the term CVC (Card Verification Code).

Both are the same code, only the type of card is different. CVV is commonly used for cards with the VISA logo, while CVC is for cards with the Mastercard logo. CVV and PIN from debit cards are two different things.

Although they are the same to protect the card, don’t let debit card users give the PIN number when the CVV is requested. CVV is used to identify transactions made with debit or credit cards, especially when used with a large amount. The transaction will be declined and the card will be blocked if it does not include the correct debit card CVV.

Types of Cards that Have CVV

Apart from debit cards, CVV can also be found on other transaction cards. Here are some types of transaction cards that have CVV:

1. Mastercard and Visa

All cards with the VISA and Mastercard logos such as debit cards and debit cards must have a CVV located on the back of the card. This is because CVV was created by the Mastercard company and followed by the use of CVV in VISA.

Cards with the VISA and Mastercard logos are valid at merchants with both logos spread throughout the world. Initially, Indonesian debit cards were only used in Indonesia, but now they can be used anywhere.

2. American Express

The next card that has a CVV system is American Express. Just like the previous card, American Express is a transaction card service made by the American Express Company.

The CVV on American Express has different characteristics. The CVV number on other cards is 3 digits, but American Express has 4 digits. This number is located on the front of the card with a smaller size.

3. PayPal

PayPal cards also feature a CVV on the visuals of the card. PayPal is a virtual account that provides online transaction services. The CVV on PayPal is usually used to make online payments.

There are CVV options given to PayPal users according to the nominal amount when making transactions. With this, PayPal users will be given multiple layers of security. Especially for users who like to make transactions.

How to Enter Debit Card CVV for Online Shopping

Debit cards are commonly used to make non-cash transactions offline and online. To make transactions when shopping online, users need to add CVV as a condition for making transactions. Here’s how to add CVV on a number of e-commerce sites:

1. Shopee

The marketplace, which is familiarly called the orange shop, provides 18 bank options for payment services using debit cards. Here’s how to use a debit card and add CVV when making payments at Shopee:

- Open the Shopee app that is already installed on your phone.

- Search for the product to buy or tap the ‘My Cart’ menu

- After that, check out the products you want to buy.

- Tap the payment method.

- Select with “Credit/Debit Card”.

- If the debit card is not yet registered, tap the “Add New Credit/Debit Card” menu. Then a column will appear that needs to be filled in.

- Enter the full name on the debit card, debit card number, expiration date, CVV code, billing address, and postal code. Everything must be filled in correctly in the available fields, especially the CVV code.

- Once filled in correctly, the user can make payment for the product they wish to purchase with their debit card.

2. Tokopedia

Next is the well-known marketplace, Tokopedia. Check out the information on how to enter debit card CVV for online shopping on the Tokopedia platform below:

- Make sure you already have the Tokopedia application.

- Open the Tokopedia app.

- Put the products to be purchased into the shopping cart.

- Check out to proceed to the payment stage.

- Tap ‘Payment Method’

- Select ‘Credit/Debit Card/Installment’ for payment.

- Enter your debit card number, expiration date, and CVV number in the fields provided.

- Select ‘Pay in Full’.

- After that, tap ‘Pay’ to make a debit card payment.

- Tokopedia will automatically connect with the bank.

- Add the authorization code sent by the bank via SMS.

- Finally, tap ‘OK’.

3. Lazada

Lazada is one of the e-commerce platforms used by many people. The following is how to enter CVV in a debit card for product payment in the Lazada app:

- Open the Lazada app that is already installed on the phone.

- Choose something you want to buy from the shops available.

- Then, put it in the trolley.

- Check out the products to be purchased in the cart.

- Review the order product list. If it is correct, tap ‘Create Order’.

- Choose a payment method.

- Select payment by ‘Credit/Debit Card’.

- Fill in the debit card number, full name of the debit card owner, debit card expiration date, and CVV in the blank fields provided. When all fields are filled, tap ‘Confirm Order’.

- Enter the OTP code sent via SMS by the bank.

- The transaction is successfully processed when a notification appears.

That’s how to enter CVV on debit cards for online shopping payments on a number of e-commerce. It is important to enter the 3-digit CVV code correctly so that the transaction process is smooth and avoid blocking the debit card.

How to keep your CVV safe

The CVV code number on debit cards must be well-maintained in an effort to protect users’ money from being targeted by irresponsible people. Here’s how to keep your CVV safe:

1. Don’t Store Debit Card Data on your Cell Phone

It is not recommended to store important data such as debit card data in the cell phone. This is done to anticipate someone’s malicious intentions when the cell phone is not in the hands of the owner. If you want to see the CVV number, users can see it directly on the debit card. The 3-digit CVV number is located on the back of the debit card.

2. Avoid the urge to upload debit card photos on social media

Some people sometimes really like to upload statuses on social media, including uploading personal data to uncensored statuses. This should not be done because there are likely to be many people who see the uploaded status. Not everyone can be trusted. To avoid someone’s bad intentions, it would be better not to upload personal data such as debit cards to social media.

3. Use PIN for Transaction Security

Currently, both debit and credit cards require the use of a PIN. We recommend that users follow the rules of using a PIN for extra security. PIN (Personal Identification Number) can provide double security on debit cards after CVV. Don’t forget to keep your debit card and other personal data safe!

Conclusion

This is the explanation of information about debit card CVV. Hopefully it can help users in understanding CVV. Also, make sure you know the safe way to avoid all forms of scamming or other fraud related to debit cards.