Artikel diperbarui pada 3 March 2024.

The advantages of using DANA as a digital wallet are numerous. In Indonesia, there are many examples, but the application is more popular than others.

If you look at the play store then the rating, number of downloads and reviews are also the most. This is enough to prove that many people use the application.

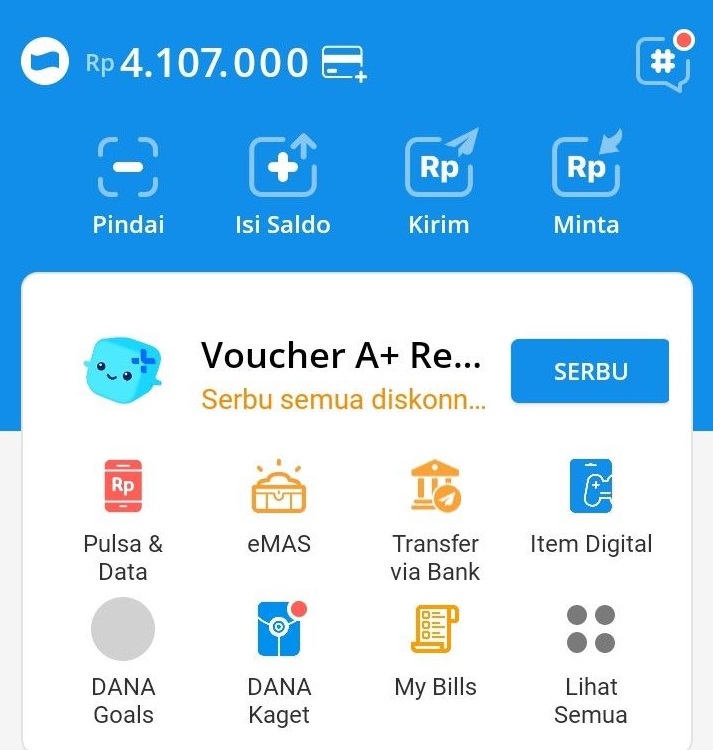

You can use it for various activities such as making digital payments to online shopping. Moreover, how to use it is also very easy, you just need to download the application on a smartphone.

Take a peek at 8 Advantages of Using DANA for Transactions

The presence of the DANA application provides many benefits for humans. No wonder so many people use it to fulfill their daily needs. Here are the benefits if you use the application.

1. You Can Pay Various Bills with Just One Account

You can easily pay many bills using just one application. Thus, you don’t need to download many applications that will fill your smartphone’s memory.

For example, to pay bills for water, electricity, BPJS, postpaid telephone, internet, insurance, installments and so on. All activities can be done without having to leave the house.

The advantage of using DANA is the opportunity to get many attractive promos and discount vouchers. Paying bills via DANA will get a 50% voucher on the second payment, the maximum amount is 25 thousand.

2. Buy Credit or Data Packages

In this day and age, almost everyone needs credit or data packages to access the internet. You can only go online if you have an internet package or credit.

Now you don’t need to worry if you run out of data packages in the middle of the night. This is because you can use the application to top up so you can go online again.

3. Pay for Shopping at Lazada or Bukalapak

Another advantage of using DANA is that it makes it easier to pay when shopping online in various marketplaces. For example, shopping at Lazada and Bukalapak. You can also use it to buy tickets at TIX ID.

This type of service is certainly very profitable, considering other digital wallets you can usually only use for 1 marketplace. For example, ShopeePay is only for shopping at Shopee and others.

4. Make Transactions at Various Merchants

Many merchants have collaborated with DANA. Thus, it makes it easier for you to make transactions using this type of digital wallet.

The advantage of using DANA is that it facilitates transactions at Alfamart, Bukalapak, Alfamidi and several banks such as BNI, Maybank, Mandiri and BCA. In addition, it cooperates with BPJS health, Cinema XXI and others.

5. Many Interesting Promos

This digital wallet also provides attractive promos at any time. Thus, you have the opportunity to get cashback or discounts every time you make a transaction at various merchants who become partners.

For example, you will get up to 50% cashback when shopping at Robinson and Ramayana throughout Indonesia. In addition, there is a credit bonus when you upgrade to a premium account.

Another advantage of using DANA is getting a 50% voucher when paying monthly bills. For example, paying installments, cable TV, water, internet and many others.

In addition, there is a “Promo Quest” feature that you can use to get vouchers. The way to get it is very easy, namely by completing the task first.

6. Security During Transactions Guaranteed

You also don’t need to worry about security during transactions. In addition, personal data is also guaranteed so as to provide comfort for all application users.

This can happen because the application has been equipped with 4 security technologies. Thus, digital payment transactions become safer and more convenient.

7. You Can Transfer Money for Free 10 Times per Month

The advantage of using DANA is that you can take advantage of free money transfer services to all types of banks. However, it should be noted that this service is only valid 10 times per month.

The existence of this feature is very beneficial, especially for business people. This is because you can save administrative costs of Rp 6,500 every time you transfer to another bank.

However, by using the DANA application, there will be no administration fee or free. No wonder more and more people are using the app.

8. Top Up Balance for Investment

The benefits of using DANA are not only used for shopping. However, you can use it to invest. In this case you need to download the mutual fund application first.

After that, you can directly open the DANA application and choose top up. Enter the balance amount as desired and choose the payment method using DANA. You can start investing with only 50 thousand capital.

You also don’t have to top up with a large amount. This is because the minimum top up amount to top up DANA balance is only Rp 10,000.

DANA is an e-wallet application that is favored by many people. This is because there are so many advantages to using DANA, especially to facilitate digital payment activities.